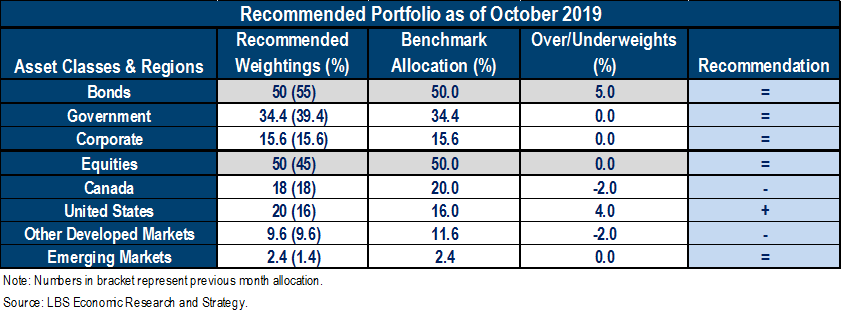

Optimism supported equity prices during the first half of September but moribund economic momentum and renewed trade tensions towards the end of the month weighted down on global indices (chart 1). Overall, our recommendation to slightly underweight equities to 45% and to overweight bonds to 55% (versus a 50% neutral allocation) generated a small loss versus our benchmark index. The S&P/TSX Composite gained 1.7% and the S&P 500 and the MSCI world each increased by 1.9%. At the same time, Canadian and U.S. bond yields rose, creating a small loss for fixed income indices.

On the U.S. side, our upward bias in U.S. equities is supported by a healthy consumer and a stronger U.S. dollar. The ECB Banking Lending Survey Indicator also increased in September, indicating a tightening in lending standards in the Euro area versus the U.S. This further supports our positive view towards U.S. equities.

We do not see any upturn in the economic momentum. The U.S. economy is showing signs of a faster deceleration. The Manufacturing ISM report for September showed U.S. manufacturing production (47.3) and employment (46.3) and new export orders (41.0) contracting, at a faster pace than in August. Moreover, the new export orders component, a gauge for global trade, has collapsed to its lowest level since March 2009 (chart 2). At, 52.6, its lowest level since August 2016, the non-manufacturing PMI shows some contagion to the broader services economy. Hence, we remain strategically defensive in our portfolio.

A limited trade deal?

However, from a tactical perspective, we believe that the high-level negotiations between the United States and China scheduled for Oct. 10-11 in Washington could result in a partial trade agreement. While positive rhetoric on that matter has always been confronted to a different reality in the past, some events leading up to the October negotiations lead us to think the odds of a limited compromise are higher this time.

Indeed, many media reports have emerged in September that U.S. officials would now accept a limited trade deal. It would involve delaying the imposition of a 30% tariffs on US$250B Chinese imports (up from 25%) and a plan to roll back existing ones. Also, China would continue to buy U.S. agricultural products and provide commitment on intellectual property issues. Such a limited trade deal seems more plausible as it is reported to be drafted based on the progress made in May when a deal was almost reached. In advance of the meeting, China has reportedly agreed to buy a “sizeable amount” of soybeans and pork from the U.S., a key issue for President Donald Trump. Such an agreement would likely be insufficient to reverse the fading economic momentum and restore businesses’ confidence. However, considering that investors are very sensitive to trade developments, we believe an interim trade deal would lift equities as well as depress bond prices. Considering the potential benefits of such an outcome, we raise our equity allocation for October from a moderate underweight position to a neutral one (45% to 50%), favour U.S. equities and selected sectors more sensitive to the trade war. Conversely, we reduce our bond allocation from overweight to neutral (55% to 50%).

We favour U.S. equities

At the same time as we return to a neutral stance, some short-term economic indicators in our tactical asset allocation model prompt us to relatively underweight Canadian equities against U.S. ones (see table).

First, the price of WTI increased by nearly 15% in one day on Sept. 16 following an attack on two of Saudi Arabia’s largest oil processing facilities which halted more than half the country’s oil production. Consequently, Canadian energy stocks, which represents around 16% of the broader TSX index, jumped by 4%. Since then, the price of oil returned back to its initial level at the beginning of the month after reports revealed that Saudi Aramco had fully restored its production capacity on Sept. 25. In addition, during the month, OPEC revised downward its global oil demand forecast, leading to a weakening trend in oil prices and a bearish signal for Canadian equities.

Second, the Federal Reserve delivered its second rate cut since the financial crisis and still looks to ease policy further until the end of the year while the Bank of Canada remains neutral. Thus, we notice a narrowing spread between real short-term interest rates in the U.S. and Canada. While this has not shown yet in broader financial conditions indexes, a declining real short-term rate differential should lead, all else equal, to an under-performance of Canadian equities relative to U.S. equities.

On the U.S. side, our upward bias in U.S. equities is supported by a healthy consumer and a stronger U.S. dollar. The ECB Banking Lending Survey Indicator also increased in September, indicating a tightening in lending standards in the Euro area versus the U.S. This further supports our positive view towards U.S. equities.

On the emerging markets front, the Chinese central policy-makers’ efforts to spur domestic growth seem to start paying off as factory activity expanded at its fastest pace in 19 months in September. Moreover, emerging markets equities would strongly benefit from a partial trade deal, as mentioned above. Hence, we gently increase our emerging market allocation from an underweight to a neutral position.

From a sectoral perspective, due to the expected trade developments mentioned above, a positive effect should be felt at the information technology sector in both Canada and the U.S. In the U.S., we continue to favor the utilities, telecom services, consumer staples and healthcare sectors, as a poorer relative performance in U.S. real GDP versus the Eurozone and a widening momentum in high yield spreads support defensive sectors. In addition, strong prices and earnings momentum should continue to boost those sectors.

Finally, in Canada, positive price momentum and a healthy U.S. consumer support adding the consumer discretionary sector for this month. We drop the TSX materials sector as hopes of a trade agreement will make investors shy away from gold.