A couple of weeks ago, Wheaton Precious Metals released a very useful study on the gold-silver ratio. It concluded that there is no characteristic value for the gold-silver ratio – that there is no mythic value (16, for instance) to which it is attracted, and to which it would return if only the world stopped manipulating its price. Rather, the gold-silver ratio rises during deflationary periods and disinflationary periods, and falls during inflationary periods.

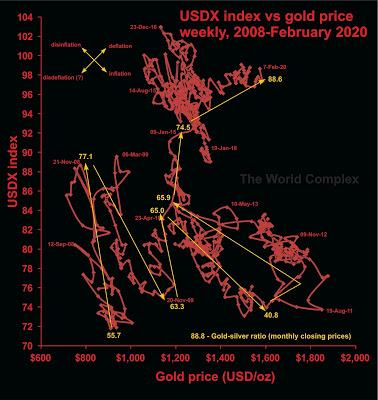

Let’s test this against some measures I’ve used for deflation/inflation. I’ll use the weekly chart of USDX vs gold price, weekly, going back to the beginning of 2008.@Gold&Silver

It is a busy visual, but what we want to do is look at longer-scale variations.

The graph above suggests that:

Why Gold Remains A Better Investment Than Silver

As long as debts are created beyond any ability to repay them, deflationary conditions will rule [and], as long as deflationary conditions persist, the gold-silver ratio may rise without limit and under such conditions, despite the gold-silver ratio being pretty much the highest in history, gold remains a better investment than silver. As much of the actual deflationary effect is brought about by cycles of inflation and disinflation, however, there are brief intervals where silver makes a better investment than gold.

Conclusion

Rather than using the level of the gold-silver ratio as your selection criterion, you need to look closely at monetary policy instead.