by Chaim Siegel of Elazar Advisors, LLC

While Facebook's (NASDAQ:FB) management has tried to get the Street to be conservative about quarterly earnings expectations, the social media giant continues to beat numbers. We think there is continued upside in earnings which can easily get us to a $200 target this year and $250 next year.

First, CFO Warning Of Slowdown Each Quarter Hasn’t Happened

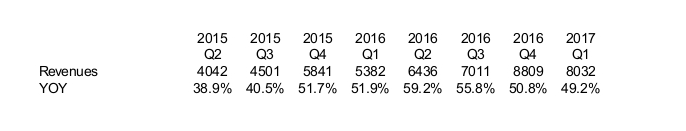

The CFO, David Wehner (or just “Wehner” as “Zuckerberg” calls him), has been saying for the last three quarters that he expects revenue growth to come down “meaningfully”. But revenues have yet to meaningfully slow down.

Here’s the revenue growth:

We see a slowdown but not one that's meaningful. Not yet.

Q2 May Not Yet Slow Down Meaningfully

In fact he may have given a hint during last quarter’s call that this coming Q2 will not slow down that much.

One issue: Facebook is slowing the page growth for pages that show ads. Wehner said on the last call that this issue will impact results “after mid-2017.”

Results for Q2 represent before “mid-2017” which means they may have quietly pushed this “meaningful” slowdown further out. They just are not seeing it.

A company that doesn’t get the slowdown they expected is a bullish outcome.

Why We Wouldn’t Worry If Revenues Do Slow

Either Facebook has been overly conservative in their forecasts—to keep Street numbers low—or they’ve been positively surprised. We’re guessing they're trying to keep numbers down which is normal policy for a conservative management team.

But even if revenues were to slow, there are two fundamental factors that would still have us buy a dip. Those two factors are user growth and ad pricing.

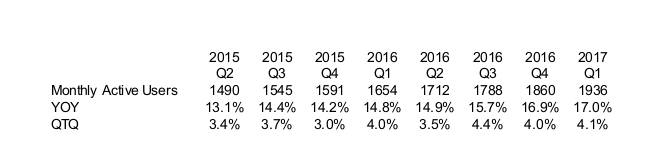

Monthly Active Users could not be more consistent. Users are increasing and the numbers have actually accelerated over the last few quarters. Each quarter the company adds about 4% more users than in the previous quarter.

These are incredibly strong metrics.

User growth is the underlying fabric of Facebook’s value. If this is strong and accelerating, you can be assured that the underlying fundamentals are still firmly in place.

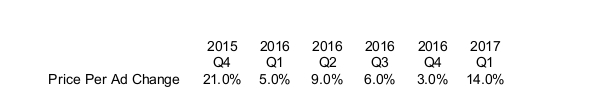

This is where the Facebook story gets exciting. While the rest of the industry is duking it out by lowering ad rates, Facebook has been raising ad rates.

Look at the price per ad growth accelerate last quarter to 14% from 3%. Demand from advertisers is increasing.

If Facebook’s issue with “ad load” ends up coming to fruition, meaning they won’t have enough pages to meet advertiser demand, we think pricing can make up some of the difference.

If pricing were moving down you have an issue. But a lower ad supply is not going to be accepted by advertising customers. They want to advertise on Facebook and they are showing their willingness to pay more.

And whenever Facebook decides to re-accelerate page growth for advertisers, you could have both page growth and pricing picking up in unison.

Why Are Advertisers Willing To Pay More Per Ad?

Until the online revolution, data was much tougher to come by. Advertisers had to either see a change in sales or do surveys to determine if their ads were effective.

Facebook has helped to the industry leap ahead for two reasons, targeting and ROI.

Targeting

Advertisers can micro-manage ads exactly as they wish, based on a user’s activity. Rather than wasting money on a wide range of potential customers they can now pinpoint customers that have previously shown interest in similar products and topics. Facebook has the data and allows advertisers to use it to target ads at these customers.

ROI

Because of the ability to target, return-on-investment is of course higher. Ads are more relevant and useful rather than spammy. The ad recipient was already interested in the product, the advertiser knew it through Facebook’s data, and you have a match made in heaven. All by way of Facebook’s data.

Advertisers are beginning to understand the power.

Anybody involved in internet marketing and advertising today is increasingly talking about the payback from using Facebook’s data to target ads. It’s something that most other platforms have not been able to offer.

Add to that the sheer size of not only direct targeting but targeting Facebook's 2 billion monthly, active users. You are targeting 2B users based precisely on their activity and interests.

Facebook’s size and ROI can easily give the company continued momentum, winning ad dollars from other media competition.

Earnings Upside

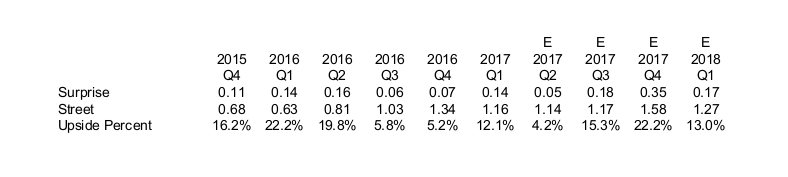

Even though the company has been conservative, they’ve still been blowing away Street estimates each quarter.

This gives us confidence that our numbers, starting in Q2 (“E”), can continue to show upside surprise.

Two More Hints Facebook Management Is Bullish

Despite the warnings from Facebook management about revenues, there are two drivers that make us think they are bullish.

They accelerated hiring last quarter which they said was meaningful. They also announced last quarter that they are no longer using the more aggressive non-GAAP measures for earnings.

These are not signs of a company that’s worried.

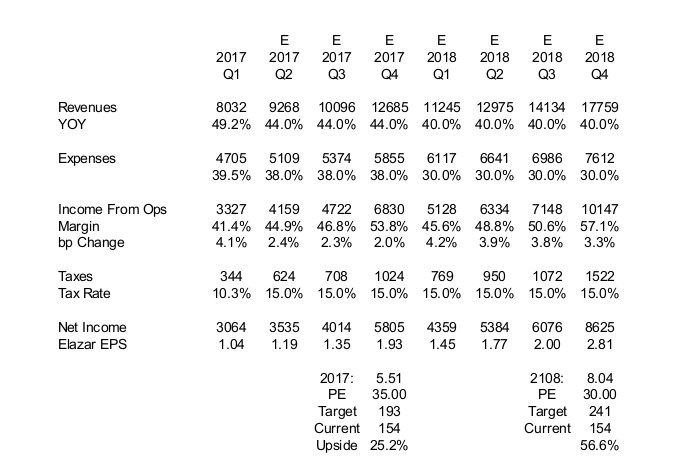

Our Model

We get to about $5.51 in earnings this year and about $8.00 in earnings next year. The company’s historical PE has been in the range of 35X. Given the high growth rate, margins, and returns we think that there can even be multiple upside.

Even remaining (what we believe to be) conservative we still get 25-50% upside in the next year or two.

Conclusion

Facebook’s potential earnings numbers support a bright future for Facebook shareholders. Facebook has a great position and incredibly high consistent growth. Q2 could also be a near-term positive surprise. We think the shares have nice upside.

Disclosure: Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.