By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Trading the European Central Bank’s monetary policy announcement on Thursday will be tricky. Not only is it one of October’s most highly anticipated events, but according to the CFTC’s Commitment of Traders report, speculative positioning is heavily skewed to the downside. Between the amount of bonds they plan to buy per month to the duration of the program and their forward guidance, there are no shortage of ways for Mario Draghi to placate the doves and the hawks. We know that the central bank’s preference is to remove stimulus slowly in a way that emphasizes their accommodative monetary policy stance. They want to taper without giving investors a reason to bring forward the timing of the first rate hike and that won’t be easy.

5 Key Questions And 4 Main Scenarios For Thursday's ECB

- How much the ECB cuts asset purchases

- How long will they commit to buying bonds

- Will they reinvest maturing securities

- Will they change their forward guidance

- Are they still worried about the euro level

Without a doubt we believe that the ECB will maintain a dovish QE bias and reinvest proceeds from maturing securities and they may even say that the euro is still too strong. However the challenge is in determining how much they will taper and for how long. Here are 4 possible scenarios and EUR/USD’s potential reaction.

- Scenario #1 (Most Likely)

Cut monthly bond buys by 30B and commit to buying bonds to September 2018. >> Depends on Guidance - Scenario #2 (Likely)

Cut monthly bond buys by 30B and commit to buying bonds to June 2018. >> Mildly Positive EUR/USD - Scenario #3 (Possible)

Cut monthly bond buys by 20B and commit to buying bonds to June 2018. >> Negative EUR/USD - Scenario #4 (Unlikely)

Cut monthly bond buys by 40B and commit to buying bonds to Sept. 2018. >> Positive EUR/USD

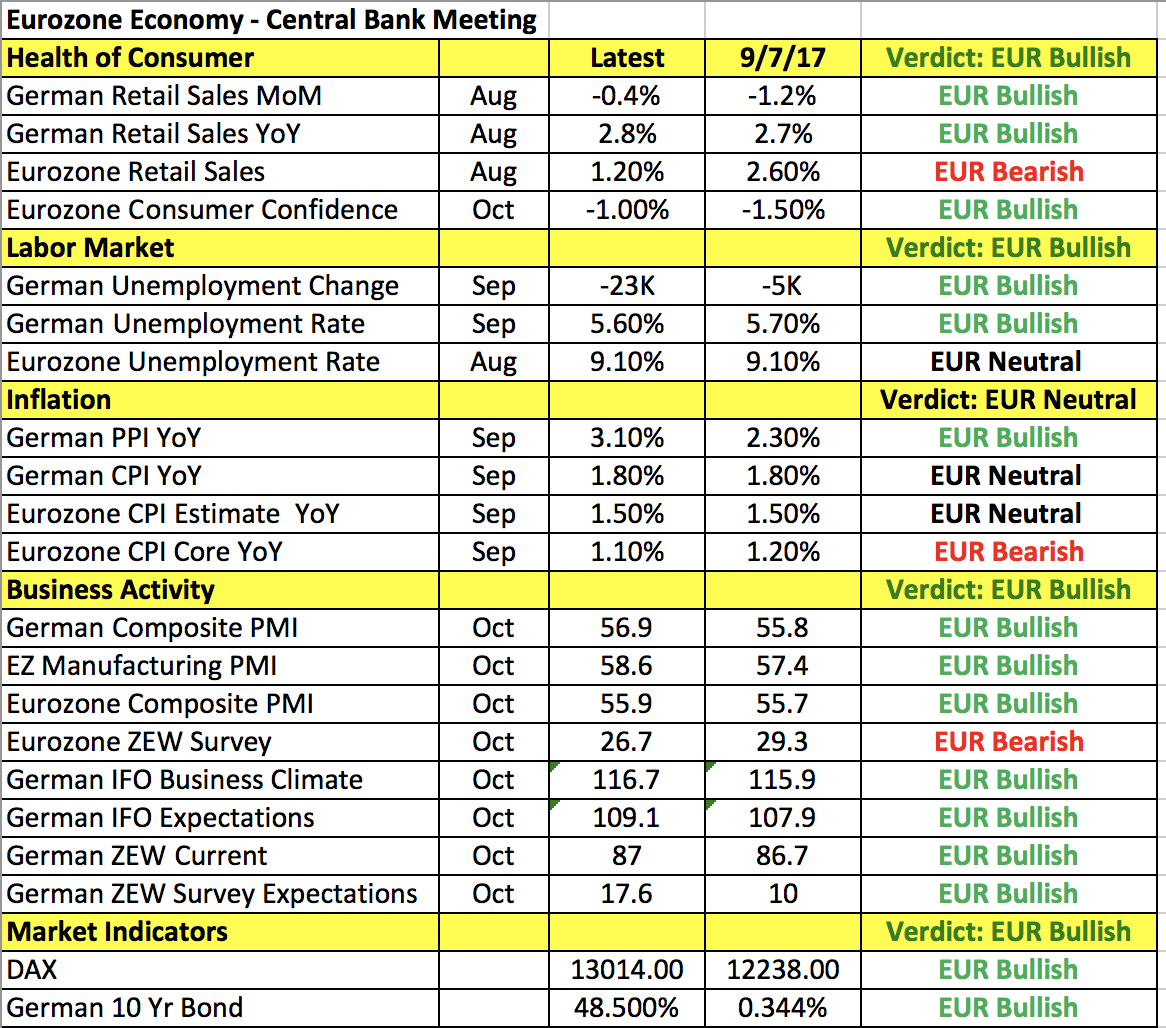

Although the following table shows widespread improvements in the Eurozone economy, we believe that the ECB will reduce their bond buying program by 30B beginning January with a commitment to continue to buy bonds until September 2018. They’ll accompany this announcement with a plan to continue reinvesting maturing bonds, a warning that QE could be increased if data deteriorates and they will stress that even with these changes, their policy stance remains extremely accommodative. How the euro trades will come down to the specifics. If they cut by more, the euro will soar. If they cut by less it will crash. If they cut by 30B and extend out 6 months only, the euro will also rise. But if they taper by 30B and extend purchases by 9 months, the performance of the euro will depend on the degree of Draghi’s cautiousness.

The euro’s reaction to this month’s ECB meeting should be comparable to the Canadian dollar’s reaction to the Bank of Canada’s monetary policy announcement. USD/CAD broke through 1.27 and 1.28 after BoC left interest rates unchanged at 1% and said they need to be “cautious with future rate increases.” The BoC was widely expected to keep rates steady but some market participants were hoping for optimism. While the BoC raised its 2017 and 2018 forecasts substantially and said less monetary stimulus will likely be required over time, investors zeroed in on their concerns about the downside risks to inflation, excess capacity in the labor market, softness in wage growth, the elevated level of household debt and how it would be affected by higher rates. Governor Poloz did have some positive things to say – he believes that production is close to full capacity and the MPR projections for higher potential are conservative. As the economy may generate more non-inflationary growth, their preoccupation with lower inflation means that they have no plans to raise interest rates again this year. In response, December rate-hike expectations dropped from 44% to 34%. Although there’s some resistance in USD/CAD between 1.2800 and 1.2835, the next stop should be 1.2925, the 50% Fibonacci retracement of the May-to-September slide.

The Australian dollar also fell sharply Wednesday, losing ground against all of the major currencies. AUD/USD dropped more than 1% while EUR/AUD climbed to its strongest level in more than a year. The sell-off was driven by Tuesday night’s softer-than-expected consumer price report. As we suspected, while price pressures increased in the third quarter, they failed to meet the lofty expectations. The 0.6% increase, against a 0.8% forecast left the year-over-year rate at 1.8%, which was not only less than the 2% increase expected but also down from the previous quarter. This report reinforces the Reserve Bank of Australia’s neutral policy stance and while continuation is generally likely after such a strong move, the 200-day SMA and June swing high provides significant support at 77 cents. The New Zealand dollar dropped to a fresh 5-month low versus the greenback but Wednesday night’s trade balance report is expected to provide some relief after last month’s significantly weak numbers.

Sterling also performed well Wednesday on the back of a stronger-than-expected GDP report. The U.K. economy expanded by 0.4% in the third quarter, keeping the year-over-year rate steady at 1.5%. Wednesday’s move took GBP/USD above the 20-day SMA but there’s resistance right above current levels near 1.3285. The U.S. dollar’s performance was mixed despite strong durable goods and new-home sales. The greenback traded lower against the European currencies and Japanese yen but saw solid gains versus the commodity currencies. Thursday’s jobless claims report and trade balance are not expected to have a significant impact on the currency.