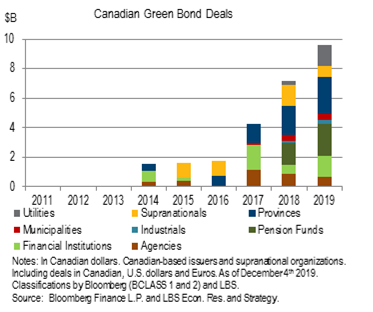

Issuance of Green Bonds by Canadian-based and supranational organizations has reached $9.6 billion this year, surpassing the $7.2-billion mark of 2018 (see chart). While the governments of Ontario and Quebec were the single largest block of issuers in 2018, the financial sector, including financial institutions and pension funds, have taken the lead in 2019. Two deals raising a total of $1.4 billion were completed this year by Canadian banks (RBC and Scotiabank). This compares to a single $600-milion deal in 2018 done by Manulife.

In 2019, CPPIB issued two green bonds: a euro medium term note ($1.5 billion) and a private placement ($665 million). Interestingly, all green bonds issued by the financial sector in 2019 were denominated in foreign currency (euros and U.S. dollars). Combining banks and pension funds, the financial sector now forms the largest block of issuers in Canada ($8.3 billion outstanding in Canadian dollars equivalent). Domestically, provincial issuance rose from $2.0 billion in 2018 to $2.5 billion in 2019. There was no significant increase in municipal and agency green bonds.

The universe of thematic bonds continues to evolve at a rapid pace. In this special report, we focus on two kinds of thematic bonds that increasingly generate interest among market participants: transition bonds and SDG-linked bonds.