by Clement Thibault

Alphabet (NASDAQ:GOOGL), Google's parent company, will report Q1 2017 earnings on Thursday, April 27, after the market close. Wall Street is expecting Alphabet to post revenue of $19.6 billion and EPS of $7.48.

1. Alphabet's past

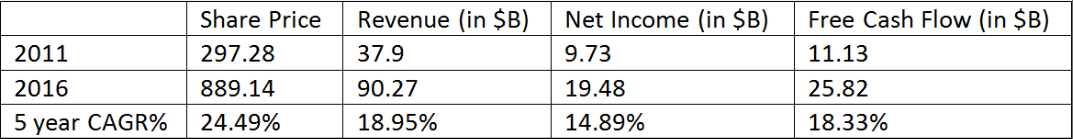

For anyone who actively follows Alphabet, the data points and growth metrics on the chart below won't be too much of a surprise.

The numbers Alphabet has generated over the past five years have done well for the company and rewarded investors handsomely.

Of course, past performance doesn't necessarily indicate future achievement, but that tends to be more true for share price than for a company's success. When the business model works and management is efficient and knows how to evolve and adapt, it's reasonable to expect that good results will continue. Clearly, Alphabet has been hitting on all cylinders.

2. Alphabet's present

Alphabet's primary growth driver is advertising in various forms—paid clicks, web impressions, video ads—via its Google search engine and YouTube. This advertising accounted for $78 billion of the company's revenue last year, or 88% of Alphabet's income. Google's advertising business depends on two critical necessities: a platform on which to display ads and the ability to aggregate data in order to tailor ads to individual users.

The main internet real estate Google sells is via AdWords, advertising displayed within search results; or through AdSense, which displays targeted ads on websites; or as video advertising on YouTube. The dominance of the Google search engine is staggering. According to NetMarketShare, Google accounts for 77% of all searches on desktop, and 96% of all searches on mobile devices and tablets.

That's absurdly high, but certainly explains the hefty revenue number. Of equal significance, Google's competition is almost nonexistent, notwithstanding how hard Microsoft (NASDAQ:MSFT) tried to make its Bing search engine relevant.

YouTube, Google's video advertising platform, is estimated to control between 60% and 70% of the online video market. In February, Google revealed that YouTube viewers are watching one billion hours of content, daily. That’s over 100,000 years of video, every single day.

Recently there's been a ruckus from some advertisers on YouTube who were not happy about placement. Their ads were shown preceding controversial videos which they feared would tarnish their brands.

As a result, a significant amount of advertising dollars were pulled from the platform. This is an important issue for Google to resolve, and quickly. Some estimate it is costing Google $1 billion in lost revenue.

Though worrying, Google is so dominant, we believe most of these dollars are actually waiting for the company to come up with a solution to the problem, and at a later date these funds will be spent on YouTube regardless.

Alphabet's Google search engine and YouTube are indeed the most visible aspects of the company, but the company's empire hardly ends there. NetMarketShare also estimates that Android, Google's mobile operating system, is currently running on 63% of all mobile devices. Chrome, Google's web browser, reportedly has a 58% market share on desktop, way ahead of Microsoft Explorer's 19% and Firefox's 12%. Chrome also has a 53% share on mobile. All of this only bolsters Google's advertising stronghold.

Alphabet currently reports $86 billion dollars of Cash and Short Term Investment. That's an enormous sum of money which opens a cornucopia of possibilities for future development.

3. Alphabet's future

Much has been written about Google's Other Bets, the portion of their quarterly report that lumps together the financial performance of shot-in-the-dark initiatives including Verily, their life sciences projects; Nest, the company's smart-home hardware products; Waymo Alphabet's self-driving car venture; artificial intelligence (which could have a huge impact on all Alphabet businesses) and more. We've never had a problem with Google routinely burning $3.5 billion to fund these projects, many of which may never work out. When you generate $25 billion in Free Cash Flow you can afford it.

As well, it creates a culture of entrepreneurship within the company, something that's rare among big corporations, and empowers all employees to be on the lookout for the next big revenue driver.

Right now, Other Bets may not necessarily be where the money is made. Nevertheless, if Alphabet finds a cure for aging, suffice to say that will make it worth more than any company's valuation ever was. But if we are sticking to plausible scenarios, Google is also offering more practical, viable services such as cloud computing capabilities.

Though Amazon (NASDAQ:AMZN) dominates this business, Microsoft and Google both have significant market share. This sector is expected to be one of the fastest growing in the next five years, and should generate significant revenue for all three companies, even if market share remains the same.

Then of course there's the $86 billion in cash and short term investment mentioned above. We’d like to see that money put to use, whether for acquisitions (could Twitter (NYSE:TWTR) make sense for this internet colossus?); for additional R&D (Alphabet's ROI has been around 14% over the past few years, which we believe is just fine); or perhaps for a regular dividend.

However, since Alphabet sees itself as an innovator in the technology space—and historically innovative tech companies have generally believed the best way to create value for shareholders is to reinvest profits in order to create additional products and services rather than paying a dividend—we don't expect Alphabet to start paying a dividend anytime soon. We believe that will only happen when the company has reached a point where it can't think of any other way to spend its money, or at a time when it concludes that its growth has peaked.

While a dividend could potentially be beneficial to shareholders, we'd view it as a bearish change to Alphabet's entrepreneurial culture. Of the ways the company could maximize its cash holdings, discussed above, the dividend is probably the least likely. However, our message to Alphabet is clear: you've got the money, don't just let it sit; create additional value for your shareholders.

Conclusion

For years, we've considered Alphabet (and its Google iteration before that) as one of the world's premier companies. Management has repeatedly proven itself worthy of our trust. Results—whether by share appreciation or company growth and development—have consistently been very satisfactory.

We see no reason to change our minds about Alphabet's long-term outlook now, even if it has run into some speed bumps following the recent YouTube advertising controversy. If anything, we believe it could create new and additional buying opportunities for customers once these short-term problems are solved.

Alphabet is one of the few companies we'd unequivocally recommend owning, even if you have to get in at all-time highs.

Of course, it helps that the company's current valuation is perfectly in line with its historical valuation. Alphabet's P/E ratio of 31 isn't too far off its five or 10 year medians, both at 29. Its Price-to-Book ratio is at 4.3, less than 10% above its five and 10 year median values of 4. Using its Free Cash Flow as a benchmark, it's almost at its cheapest rate in the past three years.

The last time we wrote about Alphabet, we concluded that the cost of stocks in general has been high, and that includes Alphabet shares. That's still true, but if you're comfortable with that, there's no reason you shouldn't own Alphabet.

We can't say it more strongly. Alphabet is one of the best companies doing business today and it should have a place in your portfolio.